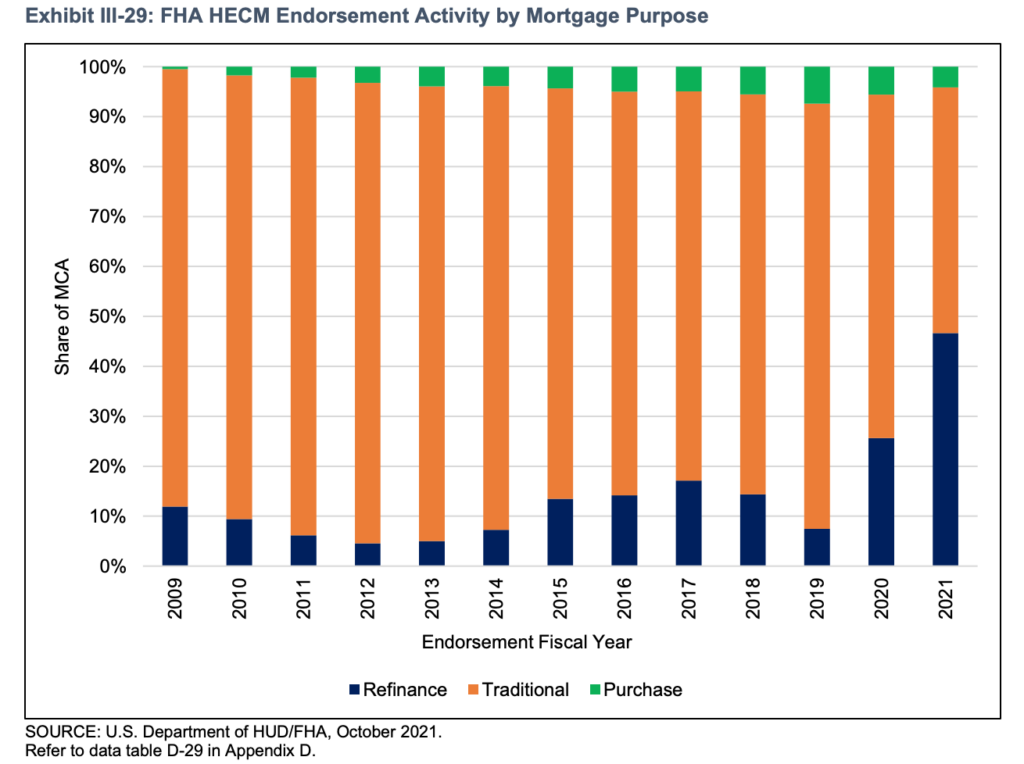

Reverse mortgage refinances made up the most sizable portion of total Home Equity Conversion Mortgage (HECM) volume in 2021 going back to at least 2009, according to data from the U.S. Department of Housing and Urban Development (HUD) and the Federal Housing Administration (FHA) released late last year. However, according to new data from those same entities and compiled by Reverse Market Insight (RMI), the scale of total annual refi volume is now coming into full view.

HECM-to-HECM refinances composed 45.9% of all HECM loans in 2021, and 50.8% of all loans in the fourth quarter of the year. Additionally, total share of HECM for Purchase (H4P) endorsements dropped in comparison to the last count, making up only 4.2% of all endorsements in 2021 stemming from higher home price appreciation (HPA) and historically low rates.

In Q4 2020, HECM refis made up 35.6% of all endorsements, and in FY 2020 they made up roughly 25% of endorsements based on data found in FHA’s Annual Report to Congress.

“The year as a whole was notable for the sustained rise in HECM-to-HECM refinances as increasing home prices and low interest rates fueled a surge in resetting existing loans to allow more access to cash and/or lower accrual rates for borrowers,” RMI said in the commentary accompanying its data release.

Total HECM endorsements rose 19.2% in 2021 to 52,945 loans, with December being the month with the highest level of production. December’s total was eclipsed in January, starting the industry off on a high note in 2022 at least as it pertains to raw volume.

Only one top 10 lender managed to score in all three performance areas measured by RMI against the 2021 data: higher growth, lower refis and higher H4P. Mutual of Omaha Mortgage recorded 50.3% growth, 30.7% in refis and 12.5% purchase business. Only 13 lenders managed to meet those thresholds out of the following 90 lenders ranked on the top 100.

In a recent RMD tabulation of 2021’s top 10 lenders, RMI President John Lunde shared additional thoughts about the large share of refi business making up total reverse mortgage volume for the year.

“Refis were the most visible evidence of the macro effects benefiting the industry, namely rocketing home values and low interest rates,” Lunde told RMD earlier this month. “As we move forward, lenders can ride refis for as long as they last but keep in mind that those same forces are extremely positive for non-refinance volume as well.”

He also described the necessity for reverse mortgage practitioners to avoid making some of the same mistakes as their counterparts on the forward side of the mortgage business considering the general lack of accurate information the public maintains about reverse mortgages, and the generally lower installed base of loans available for refinancing on the reverse side.

Read the HECM Originators report at RMI.