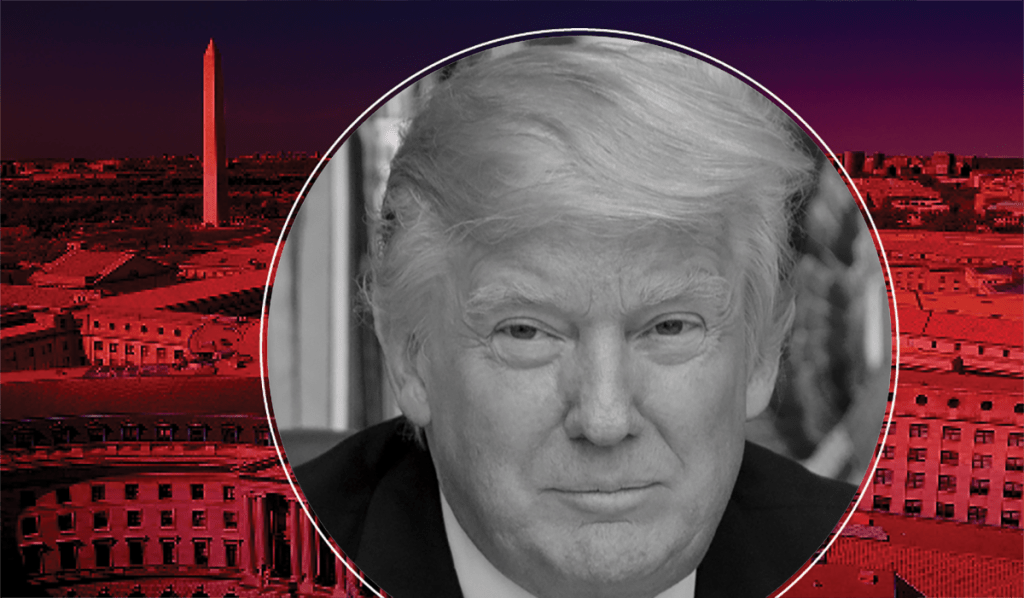

Fannie Mae and Freddie Mac shareholders hoping to be made whole in Collins v. Yellen have a new champion: former President Donald Trump.

In a Nov. 11 letter sent to Kentucky Republican Sen. Rand Paul, Trump wrote that, had he been able, he would have given former Federal Housing Finance Agency director Mel Watt the boot much sooner. Doing so would have allowed him to quicken the pace on releasing the two government-sponsored enterprises from conservatorship, he said.

“From the start, I would have fired former Democrat [sic] Congressman and political hack Mel Watt from his position as Director and would have ordered FHFA to release these companies from conservatorship,” Trump wrote. “My Administration would have also sold the government’s common stock in these companies at a huge profit and fully privatized the companies. The idea that the government can steal money from its citizens is socialism and is a travesty brought to you by the Obama/Biden administration.”

The letter is “strong, direct evidence of what was already clear from the public record: if the Trump administration had controlled FHFA two years earlier, the companies would be out of conservatorship and in private hands today,” said David Thompson, the attorney representing the plaintiffs.

Attorneys for the plaintiffs submitted the letter, which was first publicly disclosed on the news website Real Clear Politics, to the court on Nov. 30.

Paul and Trump did not return requests to comment.

In June, the Supreme Court found the FHFA’s structure unconstitutional, and allowed the removal of the director at-will. The court remanded the question of whether there was any harm from the unconstitutional FHFA directors, and whether the plaintiffs would be entitled retroactive relief.

It is unclear if the letter will sway the court in the plaintiffs’ favor. But it could be construed to show that harm was caused because the President was unable to remove Watt and install his own nominee until 2019. Trump’s letter closely aligns with at least one scenario the Supreme Court offered in its June decision.

“Suppose, for example, that the President had attempted to remove a Director but was prevented from doing so by a lower court decision holding that he did not have ’cause’ for removal. Or suppose that the President had made a public statement expressing displeasure with actions taken by a Director and had asserted that he would remove the Director if the statute did not stand in the way,” Justice Samuel Alito wrote. “In those situations, the statutory provision would clearly cause harm.”

Former President Barack Obama named Watt FHFA director in 2014. A 2018 bombshell FHFA inspector general report found Watt tried to “coerce” an employee, Simone Grimes, to have a relationship with him by dangling possible professional advancement within the agency.

Watt was never disciplined, and completed his five-year term. In 2019, months after then-FHFA Director Mark Calabria had been sworn in, the agency reached a settlement with Grimes, who is now the CFO of Acadia Insurance. The terms of the settlement were not made public.

Laura Wertheimer, the inspector general responsible for the 2018 report, has also been accused of abusing her power. She resigned this year after a watchdog report by the Council of the Inspectors General on Integrity and Efficiency found that she fostered a “culture of witness intimidation,” including through staff abuse and threat of retaliation. The report recommended her removal.