Like clockwork for the industry, every year for the last four years, the Federal Housing Finance Agency increased Fannie Mae’s and Freddie Mac’s conforming loan limits at the start of the new year.

Around the same time, the Federal Housing Administration also announced changes to its loan limits, which increased for nearly all of the country heading into 2020.

Despite the one-month scramble this creates for lenders to update their systems, adjust their marketing and educate their team, the changes to loans limits aren’t pulled out of thin air like a twisted magic trick to surprise the industry. It’s a highly calculated and predictable process.

Mortgage Bankers Association Senior Vice President of Residential Policy and Member Engagement Pete Mills commented on the importance of the way loan limit changes are handled, stating that “having it formulaic and having it pretty specific is an important signal to the market and gives the market certainty.”

“It’s speculation, but it’s not uncertainty,” said Mills. “The industry can speculate about how high they’re going to go and what the new loan limits might be. But it’s not uncertainty.”

This certainty also ushers in the opportunity for lenders to achieve one of their biggest goals — grow market share.

Leveling the playing field

For nearly a century and a half, independent mortgage banks (IMBs) have served an important role in the housing finance ecosystem, and yet, in total number, they only make up a small percentage of the market when it comes to the total number of companies.

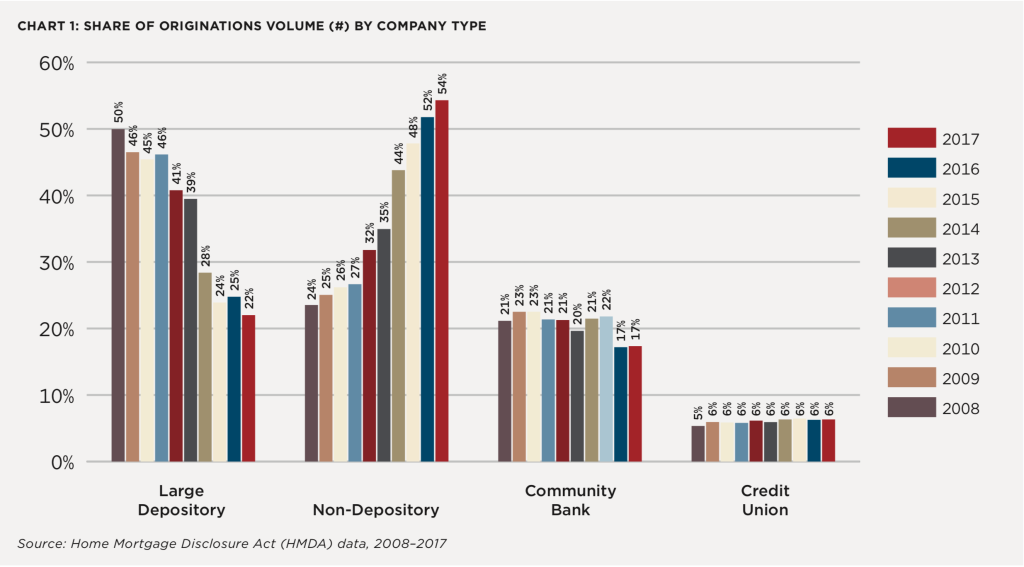

Home Mortgage Disclosure Act (HMDA) data from 2017 found that the nearly 900 IMBs in the market accounted for 16% of all HMDA-reporting companies, but originated 54% of 1-4 family mortgages. Their huge slice of the market was also up from 25% in 2008.

In a report on the rising role in independent mortgages banks, the MBA stated, “the expanded role of independent mortgage banks has strengthened our housing finance system by bringing local market knowledge, diversifying risk across a larger number of lenders and servicers, and fostering greater competition and innovation,” a sentiment that’s echoed by Residential Mortgage Services (RMS), an IMB headquartered in South Portland, Maine.

RMS CEO James Seeley and John Gray, chief operating officer and chief financial officer for RMS, explained how increasing loan limits are just one of the factors that are helping fuel IMB growth, as the limit changes allow them to be more competitive against portfolio banks.

The chart below from the MBA’s report shows how origination volume has significantly shifted away from large depository institutions over the last decade.

“When the loan limits go up, it tends to bring in more opportunities for independent mortgage bankers like us to participate more with the higher Fannie Mae and Freddie Mac limits,” Gray said.

Seeley added to this, explaining how the increases not only benefit IMBs, but also help borrowers.

“The interesting thing is that the conforming loan limit makes the portfolio banks compete on rates,” Seely said. “Increasing loan limits offer the customer more options in order to get a competitive rate because it carves into the portfolio banks, and they have to compete now. The banks pretty much have a hold on the portfolio loan limits, whereas a conforming loan limit that would get sold on the secondary market, such as Fannie Mae or Freddie Mac, is more restrictive based on its amount.”

With a strong presence in the Massachusetts lending market, RMS highlighted the benefits from the increases in loan limits that they’ve witnessed in metropolitan areas where property prices are a bit higher. A great example of this is Boston, one of the nation’s top real estate markets. Over the last decade, the median price for a home in the Boston metro area doubled from $325,000 to $650,000, according to a report from RENTCafé.

“Increasing loan limits seem to really make a difference in Metropolitan Boston in terms of providing more optionality for the customer to do business with more lenders, giving the borrower more choices,” said Gray.

Looking at Boston as an example for many in-demand metropolitan areas in the country, lenders are able to offer first-time homebuyers options when they likely had little homeownership opportunities before in those high-cost areas.

For most places in the country, the FHFA raised the 2020 maximum conforming loan limit for Fannie Mae and Freddie Mac to $510,400, a jump from 2019’s level of $484,350. When the FHFA first increased loan limits back in 2016, the agency increased the conforming loan limits from $417,000 to $424,100, meaning limits have grown by nearly $100,000 in the last four years.

Meanwhile, the 2020 FHA loan limit for most of the country increased to $331,760, which is nearly $17,000 more than 2019’s loan limit of $314,827.

With median list prices in metropolitan areas like places like New York or Santa Cruz, Calif., coming in at $515,100 and $895,800, respectively, this presents a lot of opportunities for IMBs in those areas.

“In more expensive markets, it helps first-time homebuyers since they might have been shut out for affordability because they couldn’t get the down payment that a bank might require,” said Seely. “With the increased loan limits, they might be able to go in under a Fannie Mae or Freddie Mac program with a lower down payment and actually be able to afford a home.”

This heightened competition with portfolio banks goes beyond IMBs, as brokers are also growing to take a larger slice of mortgage volume. According to the Association of Independent Mortgage Experts (AIME), the independent broker channel market share more than doubled in the last 18 months despite nearly flat growth between 2012 and 2017.

Tapping into the added market share that comes with increased loan limits, brokers are ready to serve borrowers.

“Increased loan limits are always great to see because housing prices in America continue to go up. Raising the loan limits allows borrowers to get great conforming rates and fees,” said Mat Ishbia, president and CEO of United Wholesale Mortgage.

Ishbia has stated in past coverage that independent mortgage brokers offer the most competitive options for borrowers since they can shop around on behalf of their borrowers, passing along some of the savings to consumers.

The latest increase to the loan limits would be a continuation of this commitment to trying to provide the best rates to borrowers. “Higher loan limits allow more borrowers to get a bigger loan with lower rates, lower fees and more options,” said Ishbia. “If they didn’t raise loan limits, more people would be in the jumbo market, which is traditionally more expensive with less options for consumers.”

Loan limits 101

Whether independent mortgage brokers or IMBs, loan limit increases, as of late, have been steadily helping them compete for borrowers. But the increases were born out of the financial crisis.

The Housing and Economic Recovery Act of 2008 established the market’s current guidelines around setting FHA loan limits and limits for loans backed by Fannie Mae and Freddie Mac.

After the Great Recession, “the market was flat on its back and liquidity was tight. People wanted to begin to restore liquidity to the housing market and bring markets back, which was the big driver behind the revisions in the loan limits,” said Mills.

One important piece to add when it comes to changing loan limits is that there’s a statutory framework and loan limits aren’t politicized, Mills explained.

“Federal Housing Finance Agency Director Mark Calabria was pretty clear in his confirmation hearing that he was going to follow the statute,” he said. “I think that’s a good message for the marketplace to know that there are not going to be games played with loan limits. Market confidence derives from market certainty and having a statutory framework that people follow diligently is important.”

This certainty and predictability is based around home prices. The FHFA looks at its home prices index, which showed home prices rose nearly 5% over last year’s totals, to set its loan limits. As home prices rise, the FHFA recalculates limits and adjusts the highest dollar amount they will back on a mortgage.

The FHA operates a little differently and sets single-family forward loan limits at 115% of median house prices, subject to a floor and a ceiling on the limits.

Training season

This may be the fourth-year straight that the FHFA has increased rates, but most potential buyers don’t understand what increasing rates even means. As Gray stated, increasing loan limits gives the borrower more choices. But, it’s on the industry to step up and share this with borrowers.

“We’ve found that there’s a real lack of financial education in the marketplace, especially when it comes to homeownership and the financing of homeownership,” he said. “The first-time homebuyer doesn’t really understand why a loan limit change would or wouldn’t be important. Homebuyer education will continue to be one of our main initiatives.”

This presents an opportunity for lenders to train their teams on what changes, such as increasing loan limits, mean for borrowers, so they can better compete with the portfolio banks, leveling the playing field for all originators in the mortgage space.

National home price growth gained almost a full percentage point increase in the last four months of 2019, showing that rising home prices aren’t a thing of the past. While it’s still extremely early in 2020, it’s not too late for lenders to find ways to compete as the spring home-buying market arrives early this year.