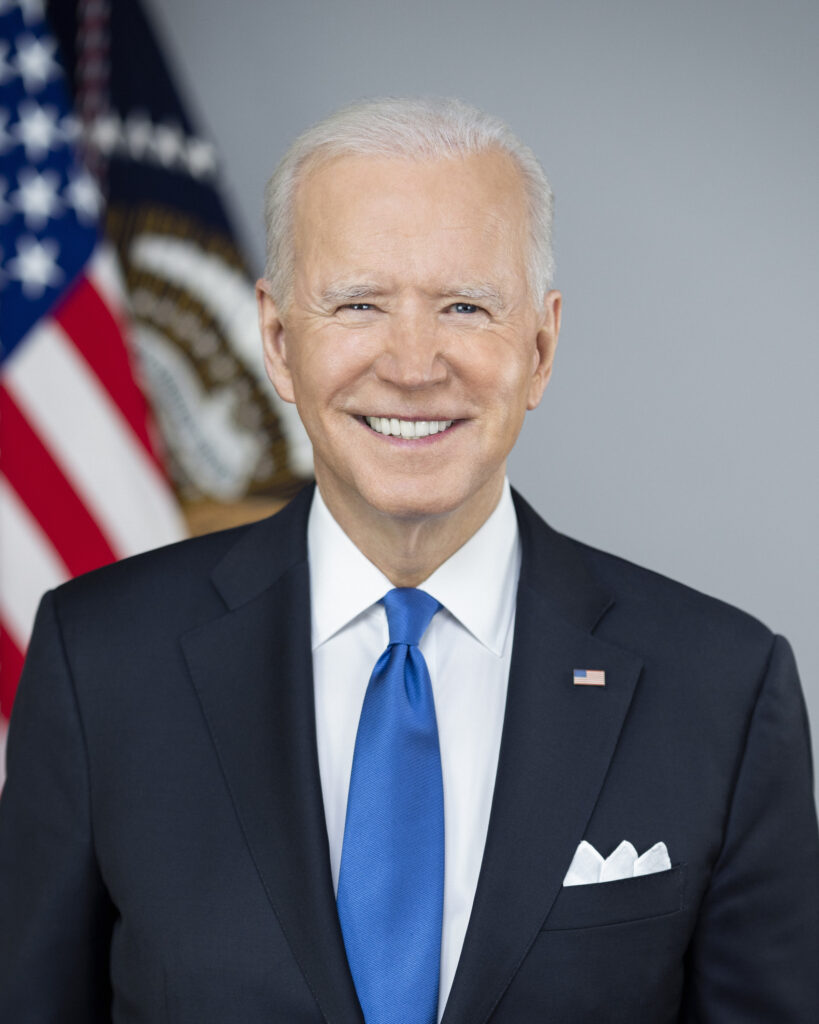

The budget proposal submitted to Congress by the White House under the administration of President Joe Biden again indicates strong performance for the Home Equity Conversion Mortgage (HECM) program inside the Federal Housing Administration (FHA)’s Mutual Mortgage Insurance (MMI) Fund, which could indicate that the program is building upon the progress it was seen to have made according to FHA’s Annual Report to Congress late last year.

This is according to a section devoted to the U.S. Department of Housing and Urban Development (HUD) in the full budget document released by the White House late last week. HUD also makes several new legislative recommendations for the HECM program including on matters related to non-borrowing spouses (NBS), foreclosure notices and the current HECM loan cap.

Positive reverse mortgage program performance

In the section of the budget devoted to HUD’s summary of loan levels, subsidy budget authority and outlays listed by program, the document reveals that FHA’s HECM program is projected to operate at a credit subsidy level equal to -4.19% in fiscal year (FY) 2023.

This means that HECM is projected to generate more receipts for the federal government than it will pay out in claims for the year’s HECM book of business, marking a potential second consecutive year of positive territory for the HECM portfolio and continued confidence in its solvency from HUD and the White House.

The estimated credit subsidy level of the HECM program for the remainder of FY 2022 is estimated to be equal to -2.54%, itself a slight improvement over the actual FY 2021 figure equal to -2.39% as cited in the budget document.

Based on the FY 2023 estimates detailed in the proposed budget, the HECM program’s estimated -4.19% credit subsidy means that it is currently estimated to outperform the -3.05% credit subsidy of the entire MMI Fund. The addition of the new Home Equity Accelerator Loan (HEAL) pilot program, meanwhile, is projected to operate at a +0.44% level, meaning it is estimated to cost the fund. However, this estimate is on a positive trajectory since the same estimate one year ago sat at +1.21%.

The HEAL pilot program is designed to “test new loan products designed to lower barriers to homeownership for first-generation and/or low wealth first-time homebuyers,” according to HUD’s “Budget in Brief” document submitted alongside the full budget proposal for 2022.

Reverse mortgage-related legislative proposals

In HUD’s separate congressional justifications document for its segment of the budget, the Department makes several legislative suggestions related to the HECM program specifically. Last year, no such recommendations were made.

The first proposal details changes HUD would like to see regarding reverse mortgage non-borrowing spouses (NBS), describing current law as “ambiguous” on the limits of foreclosure protections (such as loan deferrals) leading to questions of availability to certain NBS that were not identified during a HECM origination, with an example of a HECM borrower remarrying as one such potential scenario.

“This proposal would clarify that automatic protections apply only to non-borrowing spouses identified at origination, consistent with current policy, while also establishing flexibility to extend further protections at the Secretary’s discretion,” the recommendation reads.

The next proposal centers on removing the existing HECM loan cap, the document says.

“This proposal would eliminate the statutory cap on the number of HECM loans that can be insured by FHA, which is routinely waived in the 2023 Budget and Appropriations Acts,” it reads. As described, this limit was indeed waived in the latest budget proposal.

HUD also proposes the “removal of obsolete language” directly related to the ongoing use of a 2001 study to determine HECM premiums, which the Department says would “have no practical implications for the program.”

There is also a proposal regarding notifications of foreclosure for HECM loans, which would help improve the economic performance of FHA, the document says.

“This proposal would clarify that foreclosure notices can be provided to heirs of a deceased HECM borrower or other persons designated by the borrower in the HECM loan documents to mitigate the risk of unnecessary foreclosure delays and associated costs to FHA,” the proposal reads.

Finally, HUD makes a new proposal regarding reverse mortgage counseling specifically as it relates to HECM-to-HECM refinance transactions.

“Under current law, prospective borrowers must receive HUD-approved housing counseling to qualify for a HECM, except a borrower can waive this requirement for a refinance if less than five years has passed since the closing date of their current HECM,” the proposal reads. “This proposal would extend the counseling requirement to refinances of HECMs obtained within the last five years.”

Statement from HUD Secretary

In a document released by HUD featuring a statement on the president’s budget by HUD Secretary Marcia Fudge, the secretary describes all of the priorities HUD is aiming to achieve with the new request, giving specific attention to supporting underserved or underrepresented communities, increasing housing supply and promoting wealth-building through homeownership.

“The 2023 President’s Budget requests $71.9 billion for HUD, approximately $11.6 billion more than the 2022 annualized continuing resolution (CR) level,” HUD said in the same release. “The Budget outlines an ambitious agenda to address challenges our nation faces, ranging from climate change to housing discrimination to racial equity in homeownership and rental housing, to ending homelessness.”

Addressing shortages in manpower and in the filling of specific roles, the statement also describes investments that the Department will make if this budget is fulfilled.

“The 2023 Budget requests $1.8 billion toward salaries and expenses (S&E), $306 million more than the annualized CR level for 2022, which, in combination with carryover of 2022 funding, will support 8,326 full-time equivalent (FTE) employees,” the statement reads. “The 2023 Budget will support the gains made in 2021 and projected for 2022 and provide for continued increases in staffing, which will enable the Department to more effectively and efficiently serve households and communities across the country.”

The budget also proposes an additional $382 million for HUD’s IT fund to allow for further modernization of HUD’s aging computer systems and infrastructure, which would help bolster the Department’s standing in cybersecurity, HUD explains.