[Editor’s note: As of November 2022, we no longer use Slack, and we’re happy to share that we’ve moved to Circle for our new community platform. We will be continuing Q&As, live discussions and more in this new community platform. If you’re a member and not a part of our Circle community yet, you can click the link at the end of the article to join.]

In this HW+ Slack Q&A, Lead Analyst Logan Mohtashami gives the inside scoop on where rates are headed, whether or not he has updates to his 2022 forecast and more.

As a member of HW+, you can us join for regular 30-minute Slack Q&As, where we invite the HW Media newsroom to break down the hottest topics in the industry. Tune in for our next event with Mohtashami happening March 23rd at 12 CT in the #articlediscussion channel.

The Q&A was hosted in the HW+ Slack channel, which is exclusively available to members. To get access to the next Q&A, you can join HW+ here.

The following Q&A has been lightly edited for length and clarity. This Q&A was originally hosted on March 9.

HousingWire: Let’s start with a bang, Logan, will the inventory crisis end this year?

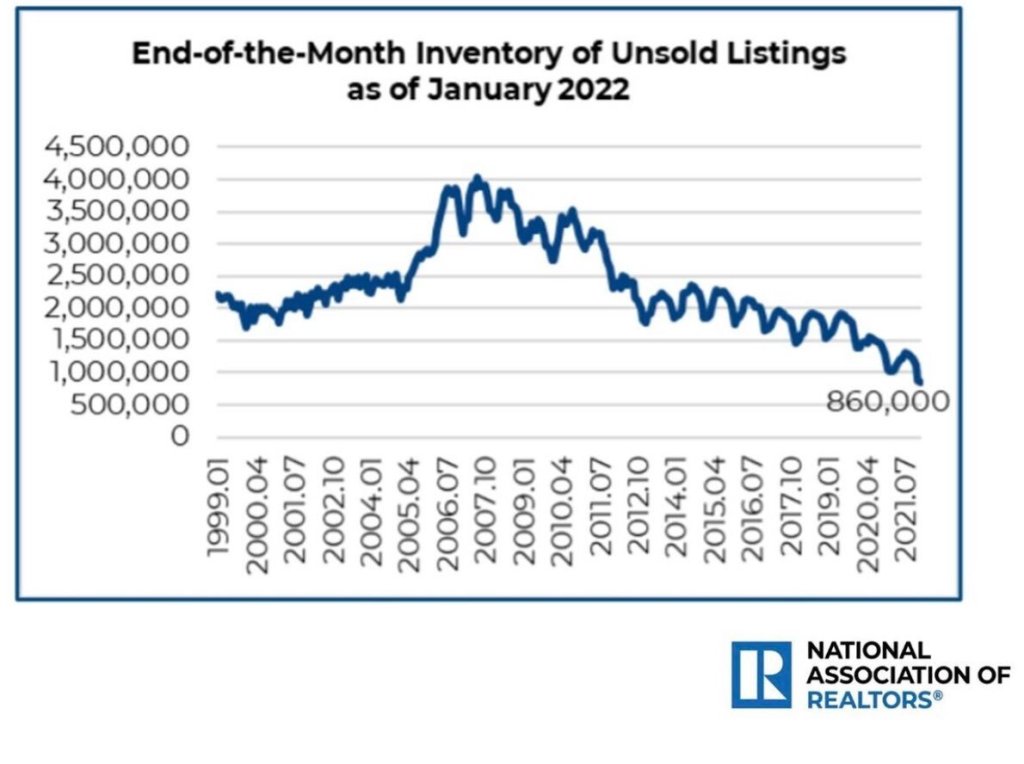

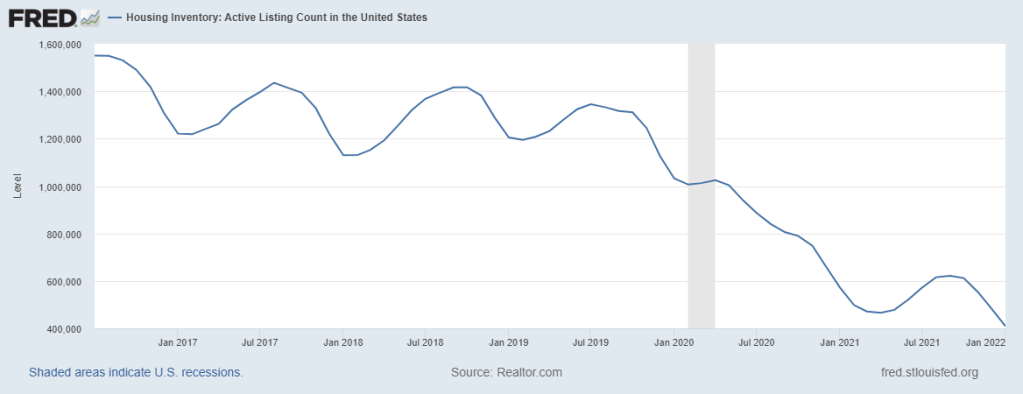

Logan Mohtashami: No, it will not, it’s gotten worse this year, and typically you can’t start a year at fresh new all-time lows and have that go away in the same calendar year. The goal for inventory is to get back to 1.52-1.93 million, which would be historically low, but it would be a sane marketplace. However, we are far from that. Inventory is about to increase as it always does during this year. We don’t want to see the fall and winter fade to fresh new all-time lows in 2023.

HW+ Member: With all of the money coming out of Rubles and a crazy equity market. Do you foresee a flight to safety in short-term yields? Thus nullifying any mortgage yield declines?

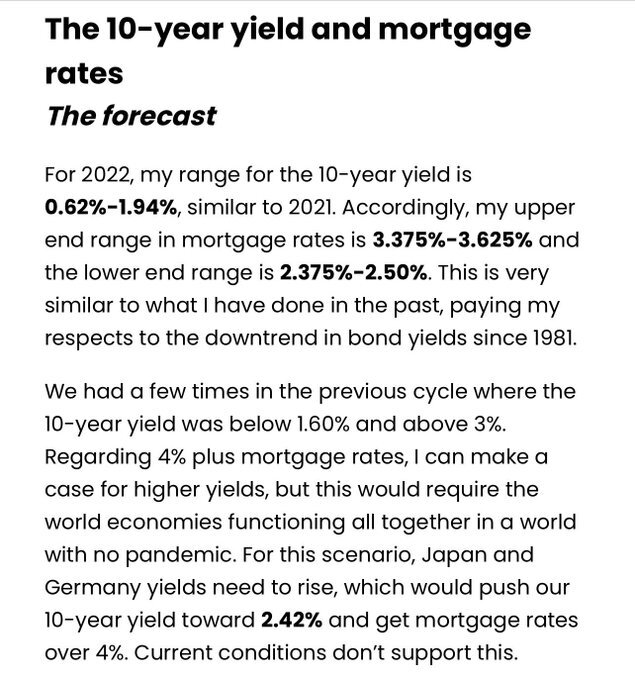

Logan Mohtashami: The 10-year yield is at 1.92% right now, it’s staying very firm, even with all the drama in the markets. If economic data gets weaker in the 2nd half of 2022, that is good premise for an inverted yield curve and long-term bonds falling. Short term yields are rising because the Fed is still in rate hike mode

I have been on an inverted yield curve watch since Thanksgiving of 2021. So, everything looks about right to me in context with my 2022 forecast and what happened with global yields earlier in the year.

Since 2019, I have been focused on the 10-year yield at 1.94%, knowing it would take a lot to break above it. Even today, with the hottest economic and inflation data in decades. We are at 1.92% as of this second.

Back to the inventory crisis. I can’t stress enough how this is the biggest problem in the U.S housing market. The only way to solve this short term is for rates to be high enough to create a cooling down in housing.

HousingWire: So why aren’t mortgage rates higher?

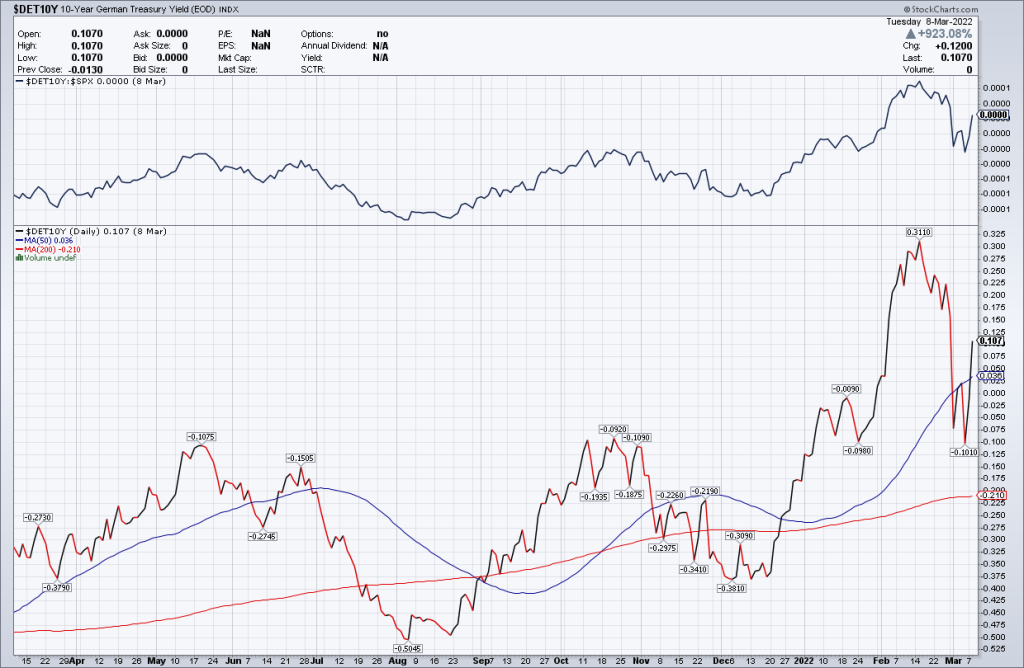

Logan Mohtashami: The downtrend in the 10-year yield has stayed intact for over four decades, and the amount of demand for our bonds is too much. Today was the first day of no Fed QE, and we just had a bond auction, and the 10-year yield is still at 1.92%. We can create a range in 2022 between 1.94% – 2.42%, but this would need global yields to rise and economic data to stay firm. That is the question going out in 2022, can this hot economic data remain hot with all these headwinds now.

I know this doesn’t get talked about much, but Germany and Japan bond yields are critical for our bonds and rates to rise. As you can see, the snapback in bond yields we had here in America the last few days also happened in Germany.

HW+ Member: The trend of rising yields in Germany seems like it is also the friend of the 10-year treasury

Logan Mohtashami: Yes, but Germany and Japan had a massive rise in yields this year vs the U.S. and are trying to break out of a low-level trend for years now.

HousingWire: Can you give us an update on how Ukraine is impacting the market right now?

Logan Mohtashami: This Invasion of Ukraine is different from other wars because of the commodity and global financial wars we are in now. As all can see, even with the significant drop in oil today, oil prices are up high with wheat prices. This is a high economic risk to world growth the longer this goes. Russia’s economy will be in a significant recession, but that doesn’t impact us. The rise in global commodity prices is not what we needed at this time. This situation needs to be monitored on a daily basis and is the biggest new economic variable since COVID-19.

HousingWire: Focusing on your latest article, how has COVID-19 affected household cash flow in comparison to the start of the pandemic versus just recently?

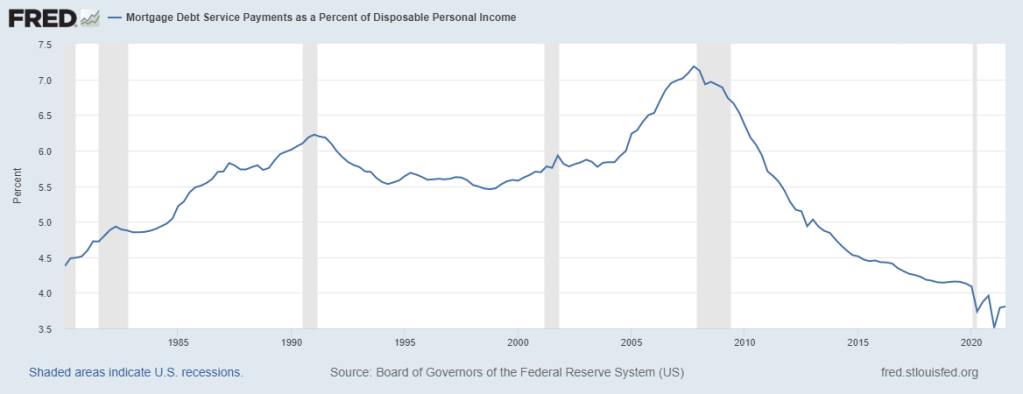

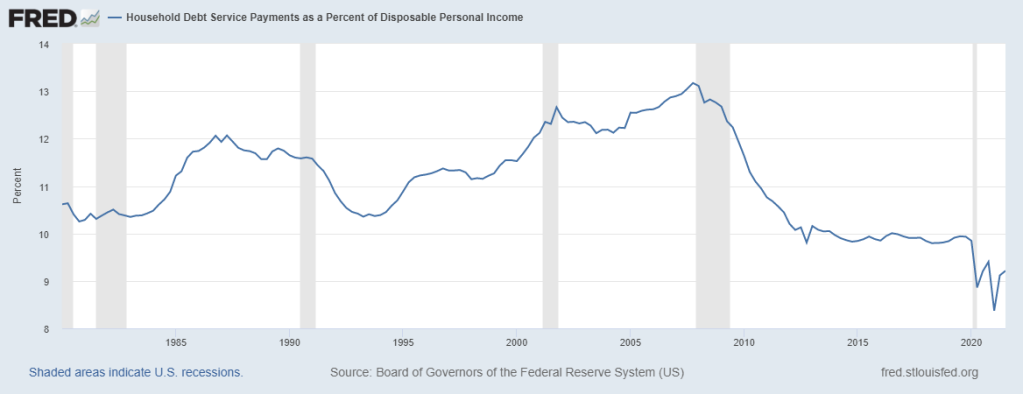

Logan Mohtashami: Homeowners’ cash flow has gotten a lot better in the past two years. Tomorrow for HousingWire, I will write an article showing how homeowner was the best hedge against inflation. Wages are up, but shelter costs have gone down for many homeowners because of the multiple refinancing years we have had over the last ten years. However, the previous two years were epic in nature. Homeowners’ Dispoible Income levels are at the best levels ever.

Since mortgage debt is the most significant debt we have as a consumer since the cash flow looks great there, it looks lovely for total household debt payments.

HW+ Member: If savings rates have been this good, that could also point to more people staying keeping, and more inventory issues nationwide? For years to come?

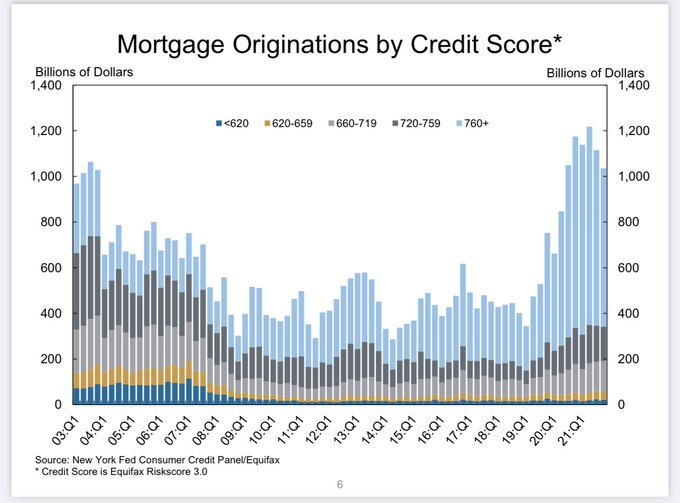

Logan Mohtashami: When you have better cash flow, your FICO scores look great. Whistle folks, nothing looks more economically sexy than this.

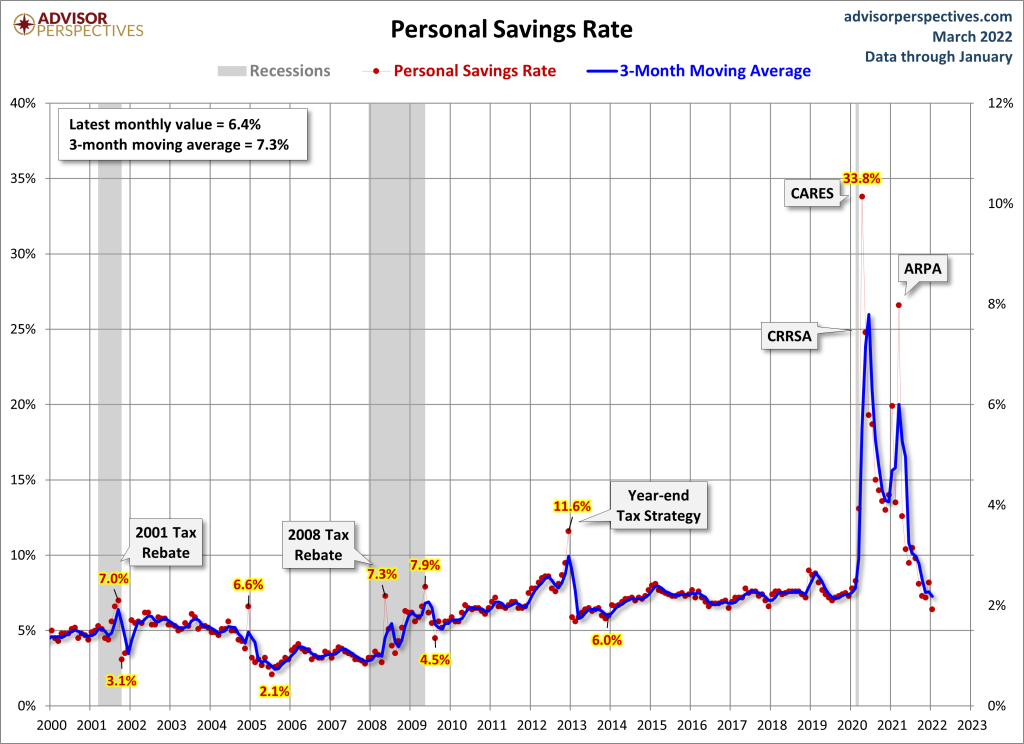

The personal savings rate the data flow has gone back to pre-COVID-19 levels. This was to be expected, but people generally have more cash and net wealth now than pre-COVID-19 levels. This data looks very healthy still.

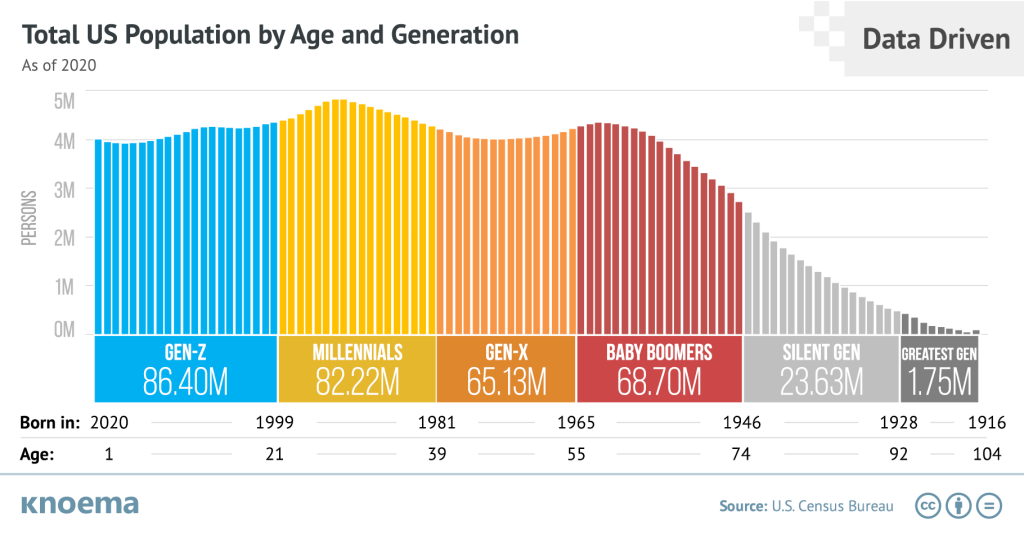

Historically speaking, you don’t want to have a high savings rate. Especially if you’re a consumption-based economy with a lot of young people. Older people tend to save more for different reasons, but we have a massive young workforce.

HousingWire: To wrap up, what are some final thoughts you want to share about the current housing market?

Logan Mohtashami: I have always been a years 2020-2024 demographic household formation guy for a long time. However, the retail spending we have seen recently is historical in nature. It’s for sure an economic boom that we haven’t seen in a long time. However, this data should moderate and already has to degree.

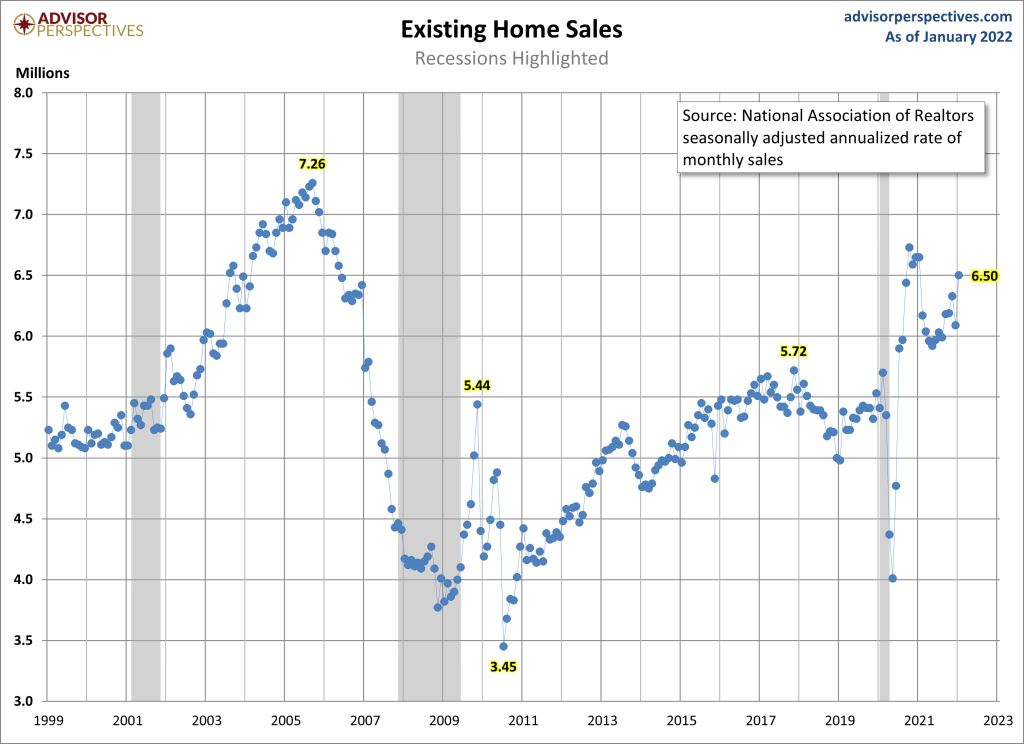

For existing home sales, just like I did last year, I expect sales to moderate and find a base to work from. My sales range for 2022 is slightly lower than last year at 5,740,000 – 6,160,000. Right now, the recent home sales have been outperforming my expectation.

Since we have had some sales prints over 6,160,000, we should have some under 5,740,000. If not, then home sales are doing solid. Last year I said the same thing with a range between 5,840,000 – 6,200,000 and had anticipated some prints under 5,840,000. We only got one. I am keeping an eye out on that and the inventory situation.

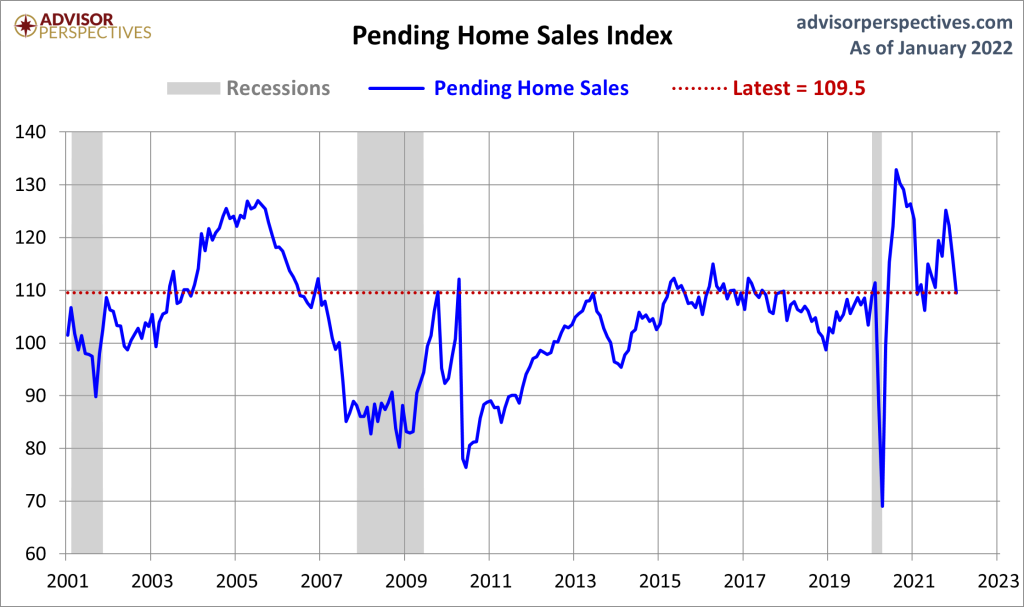

Pending home sales data looks about right to me.

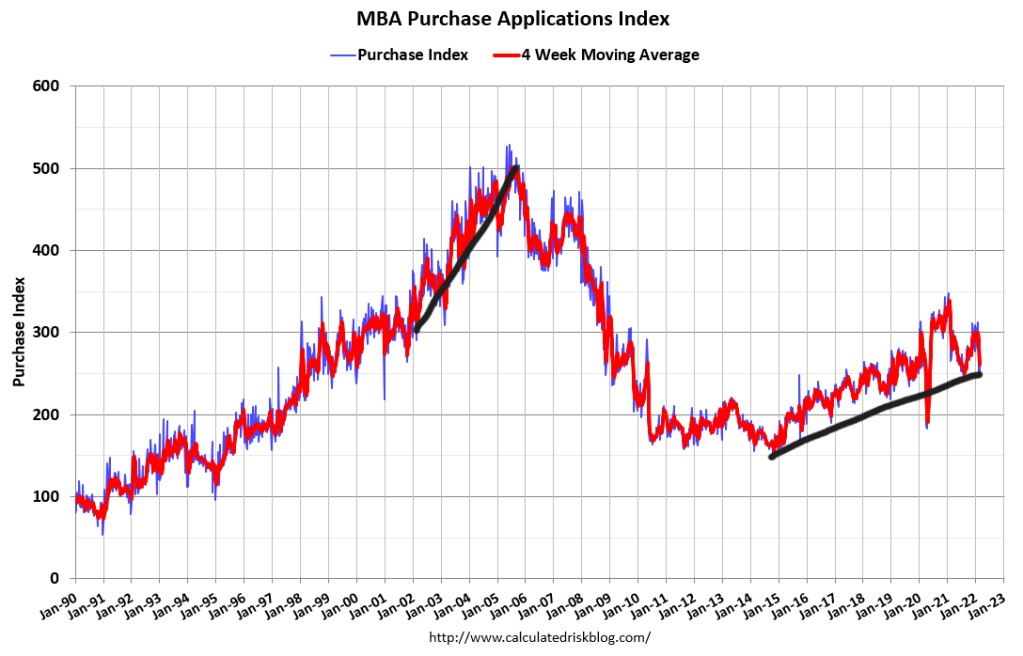

Purchase application data; there is no growth but stable demand in 2022.

Take full advantage of your HW+ membership and join our exclusive Circle platform dedicated only to HW+ Members! To join the community, go here.