For those of us in the business of analyzing the housing market, the past two years have been quite a ride. The market’s insatiable demand for real estate, combined with low interest rates and even lower inventory, created a feeding frenzy that drove insane bidding wars, sent home prices skyrocketing, and frustrated many would-be home buyers. And with the pandemic changing some of our traditional seasonal patterns, it’s been challenging at times for us to predict what would happen next.

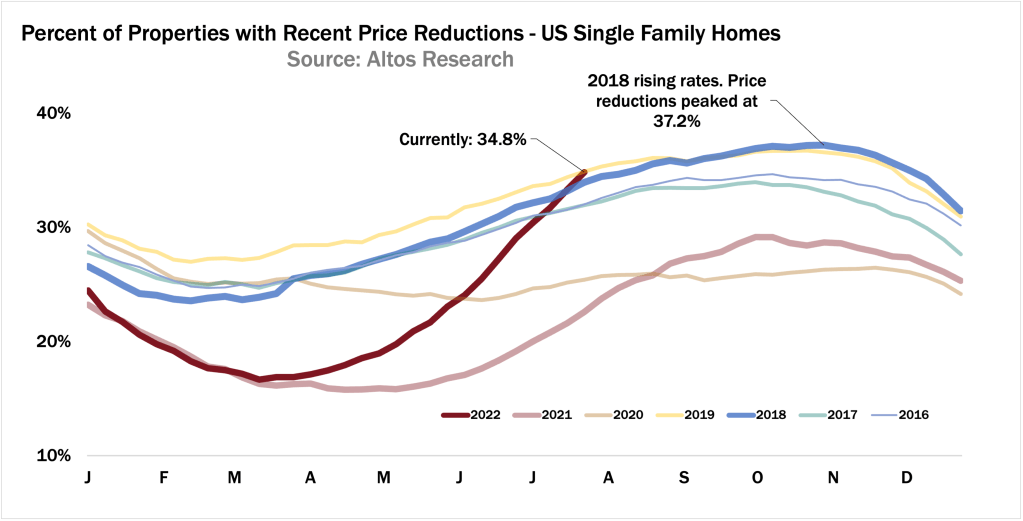

Now that the frenzy is over, we’re seeing a return to more normal patterns. Homes are taking price cuts at the typical level of about 33%, and more homes are getting relisted as a natural response to the cooling market. And as home sales slow, inventory is climbing quickly. Will we finally see an end to our years-long inventory shortage?

As we roll into the second half of the year, here’s what to expect with inventory and prices into early 2023:

1. Inventory will climb through October, but don’t expect a tsunami.

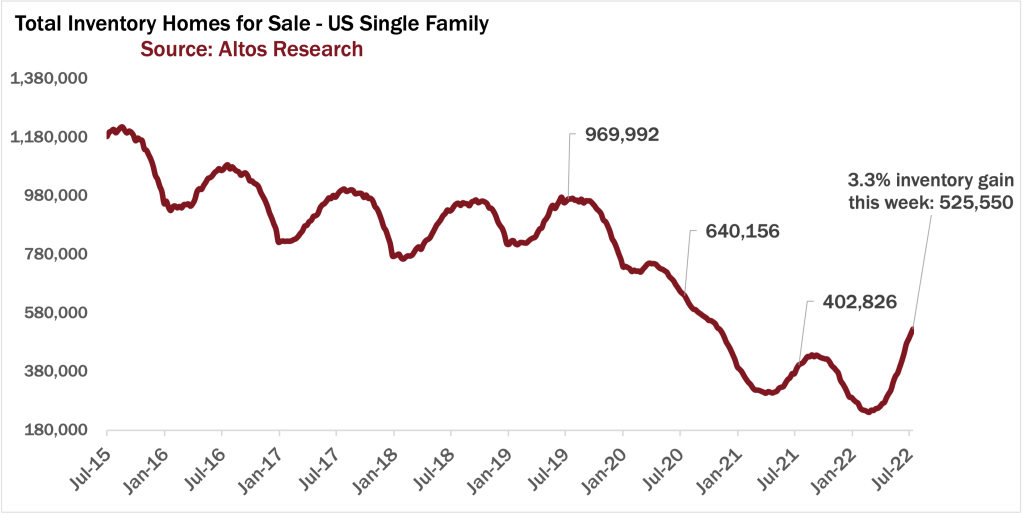

There are now 525,000 single-family homes available unsold on the market across the US. That’s the most we’ve had in almost two years, and 31% more than last year at this time. As mortgage rates spiked this year, buyer demand stopped abruptly and inventory has risen quickly.

But inventory growth may already be showing some signs of decelerating. A month ago, national inventory was climbing by 6-8% per week. Now, we’ve been in the 3-4% growth range for each week in July. It’s early, but it may be a sign that sellers are not feeling compelled to list when they face uncertainty in the economic outlook. I do expect at least a few more weeks of fairly hefty increases in inventory this summer, so the spike is not finished yet.

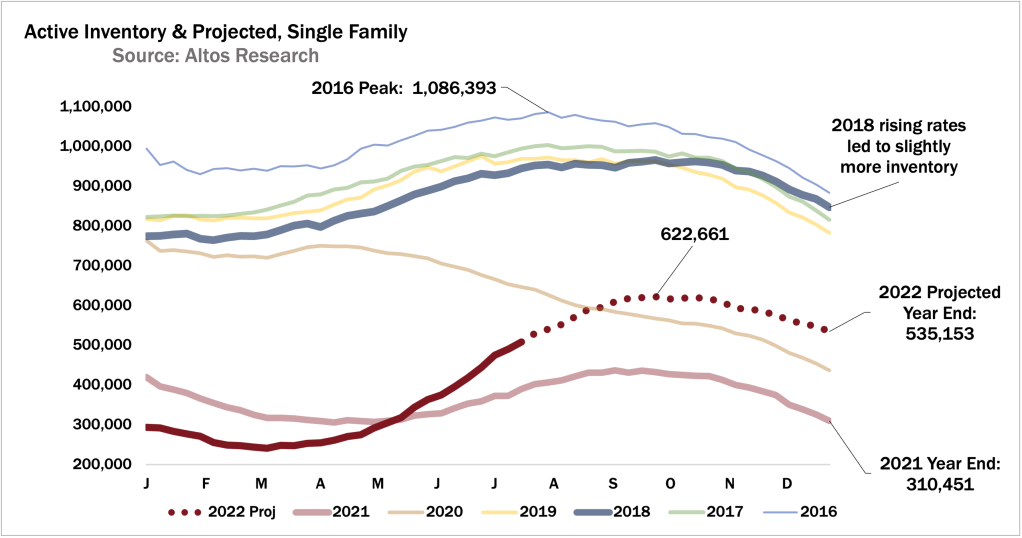

With that, the summer should peak with over 620,000 homes on the market and end the year with around 535,000. You can see the dotted line curve here as the forecast for the rest of 2022. If we see the dotted line keep climbing in October, that would signal the market is cooling more significantly than expected.

When forecasting inventory for the rest of the year, one aspect to consider is how our immediate market may be pulling supply forward from the end of the year. You can imagine that sellers who were thinking of selling at some point this year are hurrying to list now — before they perceive the market will get even slower. If that is indeed happening, that would put a cap on inventory growth later in the year.

I should note that when we talk about inventory forecasts for this year and next, what’s not visible in the data are all the exogenous variables. What happens if mortgage rates spike up? Or, if the economy tanks? These would obviously change the equation.

But assuming we have some normal seasonality, 2023 will start with still fewer available homes than we started with in 2020. Supply is at its best in a few years, which is good for buyers, but it’s still going to be relatively tight for quite a while. Don’t expect a big wave.

2. Prices will remain flat.

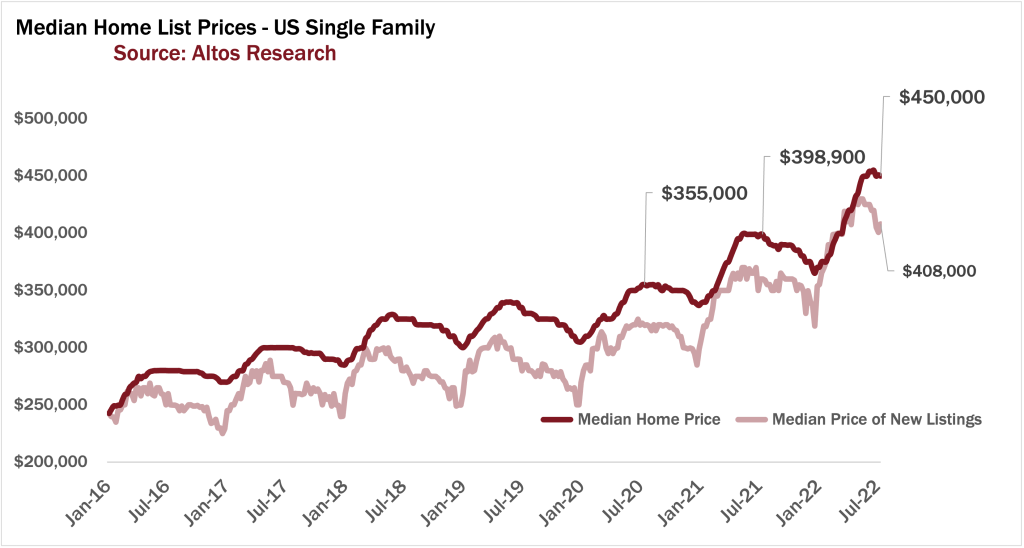

Prices are now past their seasonal peak. The median price of single family homes in the U.S. is $450,000.

The median price of the newly listed home rose to $408,000 this week, after dropping a bit last week. I mentioned that sellers may be pulling supply forward, worried that conditions will get worse later in the year. If that’s their state of mind, they’re also likely to discount the asking price just a little to be ahead of the competition right now.

Price reductions are also climbing quickly but still in the normal range of price reductions. A little more than one-third of the homes on the U.S. market have taken a price cut in the past week. This number was at a record low just a few months ago, though, so the change is dramatic.

What we’re watching for is for the slope of the price reductions to start to flatten. In the fall, new listings price at a discount first so they don’t have to cut later, so we typically see a decline in price cuts starting in the fall. But that slope hasn’t rounded the corner yet, which implies there’s still a lot of adjustment that sellers need to make. I expect that we’ll be at 40% with price reductions before the end of the summer. Using the prevalence of price reductions as a proxy for organic levels of demand in the market, that’s a strong signal why we’re likely to see no home price appreciation for 2023.

The good news is that opportunities for buyers are finally opening up. We can see that demand is still there for the homes that are priced properly. But, it sure looks like, while inventory is climbing, we’re not going to have a big wave of inventory next spring. So home buyers should plan accordingly.

Mike Simonsen is the Founder and CEO of Altos Research.